What is EFC? To start your college search, you need to be able to answer this question. If you’re like most parents starting the college search process, you don’t have a clue what EFC means. In fact, most parents don’t understand until they are well into the college application process which is not a good thing.

What is EFC? To start your college search, you need to be able to answer this question. If you’re like most parents starting the college search process, you don’t have a clue what EFC means. In fact, most parents don’t understand until they are well into the college application process which is not a good thing.

So what is EFC? EFC stands for “Expected Family Contribution” and is the term used by the Federal Government and colleges to state how much parents are expected to pay for their child’s college education. (EFC is being renamed the “Student Aid Index” for the 24-25 award year but it will still function the same as EFC.)

Your EFC appears on your Student Aid Report (SAR) which you receive by submitting the FAFSA form. FAFSA stands for the “Free Application for Federal Student Aid” which students must submit to qualify for any federal financial aid and many state financial aid programs. Whether or not you think your student will qualify for financial aid, there are good reasons to complete the FAFSA anyway.

Submit FAFSA – get EFC (or SAI). With me so far?

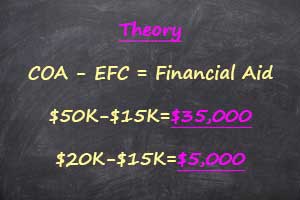

EFC: Financial Aid Theory

Colleges use your EFC to determine how much financial aid to award you. Let’s go over what this means in the ideal world first. Assume that your Expected Family Contribution is $15,000. (This probably isn’t going to be a realistic number for most families but more on that later.) Each school has a COA, Cost of Attendance, which includes tuition, fees, and room and board. Your financial need would be COA-EFC.

Based on the $15,000 EFC, a college that costs $50,000 a year should provide a financial aid package of $35,000 while one that costs $20,000 would only provide $5,000. This is why counselors, admission officers, and teachers are constantly telling students to apply to colleges regardless of their sticker price.

Based on the $15,000 EFC, a college that costs $50,000 a year should provide a financial aid package of $35,000 while one that costs $20,000 would only provide $5,000. This is why counselors, admission officers, and teachers are constantly telling students to apply to colleges regardless of their sticker price.

In the ideal world, the financial award from the college would cover the calculated need. Theoretically, the student’s cost would be only the Expected Family Contribution and this amount would be the same regardless of the school he decides to attend. It should cost the same for the student to attend a school that costs $20,000 or one that costs $50,000.

Now let’s go over what actually happens in the real world.

EFC: Financial Aid Reality

In the real world, the amount of aid that a school can provide depends on its endowment, tuition, and institutional priorities. In general, private institutions have much larger endowments than public institutions. They also use their higher tuition to provide more scholarships and grants. This is why they can offer more financial aid than public universities.

But there can be significant variation even among public schools within a state which can make a big difference in how much you pay for college. Consider the differences between the eight public universities in Texas as seen in the following table.

| Name | % Freshman with need | Avg % of Need met for Freshman | Avg Need-based award for Freshman | Endowment per Student | % Freshman Receiving Pell Grants (20-21) |

|---|---|---|---|---|---|

| The University of Texas at San Antonio | 72 | 48 | $9,095 | $6,515 | 51 |

| University of Houston | 68 | 58.1 | $10,680 | $23,683 | 43 |

| Texas Tech University | 52 | 61 | $10,072 | $20,798 | 22 |

| The University of Texas at Dallas | 48 | 68 | $12,232 | $21,908 | 24 |

| Texas A & M University-College Station | 43 | 69 | $12,901 | $208,022 | 20 |

| Sam Houston State University | 68 | 74 | $8,932 | $7,033 | 42 |

| The University of Texas at Austin | 51 | 76 | $14,257 | $101,832 | 29 |

| Texas State University | 66 | 78 | $9,273 | $6,906 | 40 |

According to the Common Data Set for these schools, the percent of freshman with demonstrated financial need ranges from 43% to 72%. However, the average percentage of need met is at most 78%. And this is the average, the percentage of students who had their full need met is going to be much lower, probably under 30%. This could have something to do with the schools’ endowments. Yet, the average percentage of need met for freshman at UT Austin and Texas State University was about the same even though they have dramatically different endowments per student.

Of course, there are plenty of other factors that come into play as far as meeting need. The schools’ sizes range from just under 16,000 full-time undergraduates to over 50,000. The schools do not charge the same for tuition. The percentage of freshman receiving Pell Grants also varies from just 20% to 51%. It’s a lot easier for a school the meet the need of students who need less than $5,000 than those who need $10,000 or more.

The point is that none of the schools meet 100% of need. The reality is that most freshman at these colleges, and at most colleges in general, will not have their financial need fully met.

Your Expected Family Contribution can make even more of a difference at private schools. If your EFC is $15,000, the $50,000 private school should provide you with $35,000 in financial aid. Too good to be true you say? Well, it is for some people and not for others.

Free Download of List of Colleges for those with EFC=0

Defining Financial Need

What am I talking about? There are a limited number of schools that state they will guarantee to meet all demonstrated financial need. The tricky part is that they get to define your need.

The schools are in no way obligated to accept the government’s definition of your need as defined by the EFC (it is their own money they are giving away.) They can use their own Institutional Methodology (IM) to calculate financial need instead of the Federal Methodology (FM) used by the FAFSA. Therefore, the EFC the college calculates may share little resemblance to the EFC you received in your SAR.

Many schools request additional financial information from students, including taxes and bank statements, before awarding financial aid. An increasing number of schools require students to complete the CSS PROFILE, a financial application from the College Board which requires much more information than the FAFSA.

Oh, and you have to pay the College Board $25 to submit the form and then another $16 per school. The school using its own Institution Methodology (IM) could decide that your EFC isn’t the $15,000 calculated by the Federal Methodology (FM) but $25,000 based on their calculations. However, you could also have a much lower EFC at a PROFILE school because of the other information they consider. In any case, you’ll also probably have to ask for the EFC since schools that use the PROFILE don’t have an equivalent of the SAR.

Most colleges cannot meet 100% of need

Other schools may not change your EFC, they just don’t provide enough aid to meet the demonstrated need as seen in the listing of Texas public universities example. This is called “gapping” which most schools will do to a certain extent because they don’t meet 100% of need. Some students may have 100% of their need met while others may have only 30% of their need met. You will also find some schools’ financial aid awards that offer students only the opportunity to take out federal and private loans.

Most private schools are also not “need blind.” This means that as the admission’s office gets closer to filling its class while starting to run low on financial aid funds, they are going to consider an applicant’s ability to pay tuition in their decision to admit. If a student can’t afford to attend the school without financial aid and there’s no more aid to be given, it makes sense for the school to admit someone who can pay full price.

So to sum up the situation so far:

- you may get more aid in loans than in grants

- the school may use its own institutional formula to determine your need

- the school may decide not to cover all of your demonstrated need (See Muhlenbergs’s The Real Deal on Financial Aid)

- requesting financial aid may reduce your chances for admissions

Don’t get totally disgusted with the process and decide you would have better luck playing the lottery. Next week in Part 2, you’ll see how there is still plenty you can do to reduce your college tuition bill.

CONNECT WITH OTHER PARENTS PLANNING FOR COLLEGE AND FIGURING OUT HOW TO PAY FOR IT

JOIN THE COFFEE CUP COLLEGE PLANNING FACEBOOK GROUP

Start creating your own college list using the DIY College Rankings spreadsheet.

64 thoughts on “Why Your EFC Should be how you Start Your College Search”