Everyone wants to know if colleges are going to open next fall. Or rather if they are going to open for in-person classes since by now the colleges have demonstrated their ability to conduct virtual classes. Of course, if they are mandated to remain shut-down, it’s not a question they have to answer. But otherwise, there are a lot of reasons why colleges will be welcoming students on campus for classes coming this fall and they pretty much all come down to money.

Everyone wants to know if colleges are going to open next fall. Or rather if they are going to open for in-person classes since by now the colleges have demonstrated their ability to conduct virtual classes. Of course, if they are mandated to remain shut-down, it’s not a question they have to answer. But otherwise, there are a lot of reasons why colleges will be welcoming students on campus for classes coming this fall and they pretty much all come down to money.

Basically, colleges need it to stay afloat and they’re general operating model is to get it by charging students tuition. Unfortunately, many students are in no shape to pay tuition at the same rates as before because their families are living in the same economy as the colleges.

Endowment Sizes

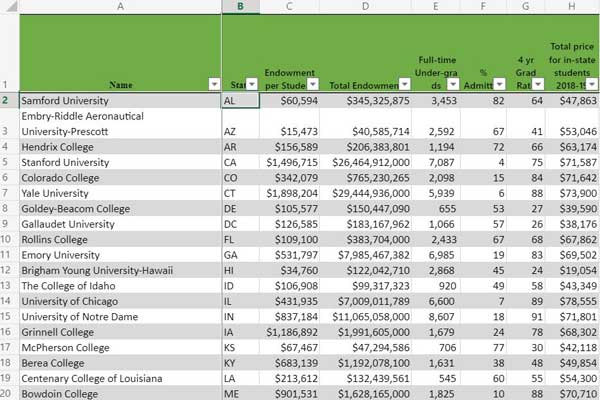

The obvious solution for some colleges will be to dip deeper into their endowments to get through the coming year. But not all endowments are created equal. The following shows the private schools with the largest endowment per student by state.

Private Colleges with Largest Endowment Per Student by State

As you can see, some colleges have a lot more to dip into than others as far as endowments go. The next table list the public universities with the largest endowment per student by state.

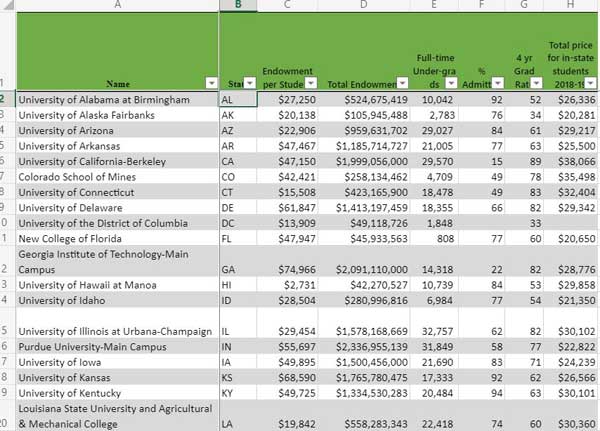

Public Colleges with Largest Endowment Per Student by State

Get the endowment per student for all colleges with the

DIY College Rankings College Search Spreadsheet

Again, there is quite a bit of difference between those with the most and those with the least. You would imagine that public universities, unlike private institutions, would be able to get more help from state legislatures. Probably not. During the Great Recession state spending on higher education decreased significantly and hadn’t fully recovered in many states before COVID-19 struck. With unemployment already at five times the rate it was then, the situation is only going to be more dire.

So that brings us back to the endowments–will they be able to help out institutions and students? Probably not as much as people think. Most endowments have some restrictions on how the money is spent. Often less than half is available for unrestricted spending, meaning administrators can use it as they see fit. The rest may have been donated to fund a new gym, endow a department chair, or fund research labs. Some may have been obligated for financial aid but this is never as much as people think.

Furthermore, the value of the endowments are shrinking like everything else with the stock market. The resulting situation is that fund managers are even more resistant to spend. Yet, they always seem to be holding back in good times in case of a rainy day. Go figure.

Chances are that colleges with endowments reserves will make the most of them to get through this coming year. However, students shouldn’t expect financial aid to be the priority. In fact, this will be the year to expect a decline in the number of colleges meeting 100% of need. More colleges will become need aware which may make it the year for the student with the full-pay hook.

Will Endowments Help Students?

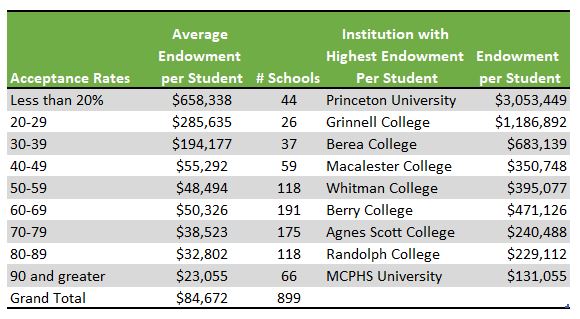

What does this mean for the student? Go ahead and keep endowment stats in your mind. The following shows the average endowment per student by acceptance rates so you can do a better job of comparing apples to apples.

But also keep in mind the following:

- It’s a lot easier for a college to meet 100% of need of a student who only needs $5,000 rather than $30,000.

- Colleges get to define need, expect more to require students to submit the PROFILE for financial aid which may consider things such as home equity and car year and model.

- Merit money will still be available but it will be more competitive.

- Expect colleges to be a lot more aggressive in getting students to commit early and put down deposits. When on the receiving end of this sort of attention, families need to remember that they are in the driver’s seat.

- Gap years, official and unofficial, may be a good idea.

- With the need to fill classrooms, transfer students should find the process easier and maybe even with better financial aid. After all, they won’t be needing it for all four years.

- Community colleges are likely to be packed. Not only will there be students staying closer to home or trying to save money, more people return to school during economic downturns. If community college is your backup, don’t wait until the last minute to register.